|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

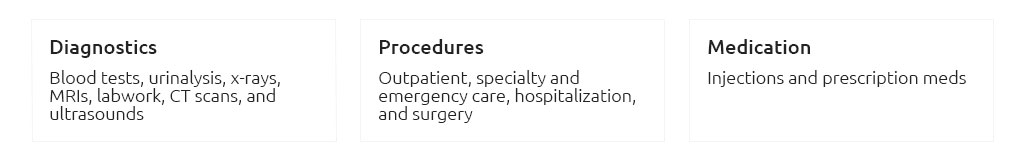

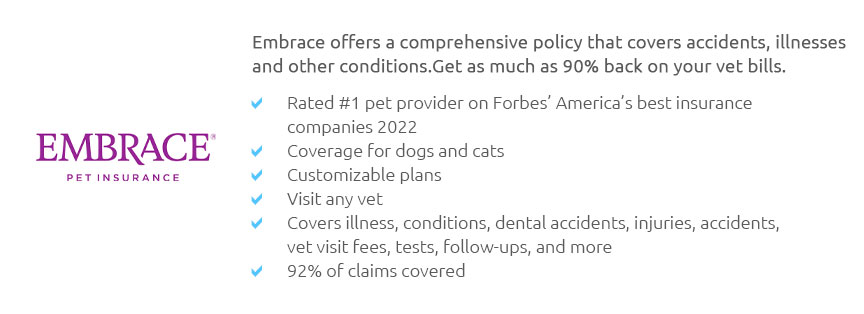

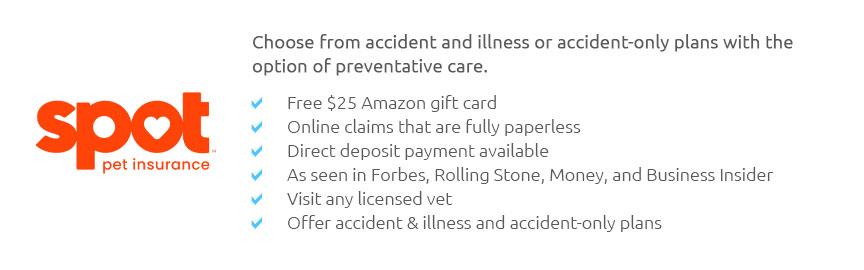

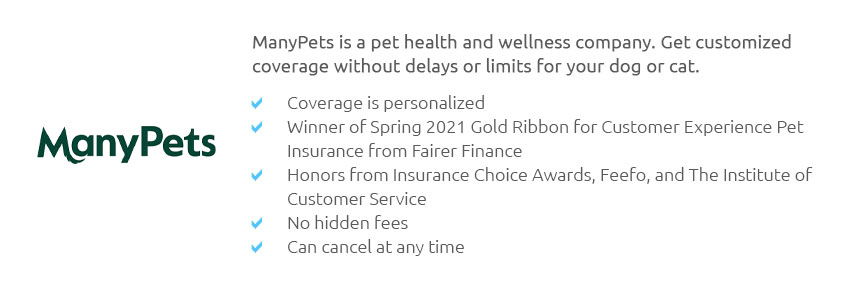

Understanding Multi-Pet Insurance: A Lifetime Commitment to Your Furry Family MembersIn today's world, pet ownership has transcended the traditional notion of having just one furry companion. Many households now embrace the joy and chaos of a multi-pet family, and with this delightful expansion comes the inevitable question of how to best protect and care for these beloved animals. Enter the concept of multi-pet insurance lifetime-a financial safety net designed to ensure that all your pets receive the healthcare they need, for the entirety of their lives. Multi-pet insurance lifetime policies are becoming increasingly popular, offering pet owners peace of mind by covering multiple pets under a single policy. This type of insurance not only simplifies the administrative burden of managing separate policies but also often comes with a discount, making it an attractive option for those with more than one pet. In essence, it is a commitment to safeguarding your pets' health over the long haul, providing comprehensive coverage that spans the lifetime of each animal. When exploring multi-pet insurance lifetime options, several key features and benefits stand out. First and foremost is the potential for cost savings. Insurers frequently offer a multi-pet discount, which can make a significant difference in the overall cost of insuring multiple animals. This discount is typically applied to the additional pets added to the policy after the first, making it a financially prudent choice for pet parents. Another crucial aspect of multi-pet insurance lifetime policies is the breadth of coverage they offer. These policies often encompass a wide range of services, from routine check-ups and vaccinations to emergency care and chronic condition management. This comprehensive coverage ensures that all your pets are protected against the unexpected, providing a financial buffer against costly veterinary bills. Moreover, lifetime policies mean that chronic conditions diagnosed during the policy term are covered for the life of the pet, without the risk of exclusions at renewal. It is important to consider the different types of policies available. While all lifetime policies offer ongoing coverage for long-term conditions, the specifics can vary. Some insurers provide a per-condition limit, which caps the amount payable for each illness or injury, while others offer an annual limit, which resets each year. The choice between these depends largely on your pets' needs and your financial situation. As with any insurance product, it is vital to read the fine print and understand the terms and conditions. Considerations such as the age limit for new policies, waiting periods, and exclusions for pre-existing conditions are essential factors to weigh. Furthermore, some policies may offer added benefits like dental cover, behavioral therapy, and overseas travel insurance, which could be particularly appealing to some pet owners. Now, let's delve into some of the popular options available. Insurers such as Petplan, ManyPets, and Healthy Paws have garnered reputations for providing robust multi-pet insurance lifetime policies. Petplan is known for its extensive coverage options and flexibility, offering plans that can be tailored to fit specific needs. ManyPets, on the other hand, is praised for its competitive pricing and comprehensive coverage, making it a top choice for budget-conscious pet owners. Meanwhile, Healthy Paws is celebrated for its straightforward policies and excellent customer service, ensuring that claims are processed swiftly and efficiently. Ultimately, choosing the right multi-pet insurance lifetime policy depends on a delicate balance between cost, coverage, and personal preference. It is a decision that requires careful consideration, but one that can offer significant peace of mind. As a pet owner, the assurance that your furry family members are protected for life is priceless, allowing you to focus on what truly matters: enjoying the unconditional love and companionship they bring. Frequently Asked QuestionsWhat is multi-pet insurance lifetime?Multi-pet insurance lifetime is a type of insurance policy that covers multiple pets under a single policy for their entire lives, offering continuous coverage for conditions diagnosed during the policy term. How does a multi-pet discount work?A multi-pet discount is a reduction in the insurance premium offered by insurers when you cover more than one pet under the same policy, often applied to the additional pets after the first one. Are pre-existing conditions covered by multi-pet insurance lifetime policies?Generally, pre-existing conditions are not covered by multi-pet insurance lifetime policies. It's crucial to check the policy details as each insurer may have different definitions and conditions regarding what constitutes a pre-existing condition. What factors should I consider when choosing a multi-pet insurance policy?When selecting a multi-pet insurance policy, consider factors such as the coverage options, cost, limits (per-condition or annual), exclusions, and any additional benefits like dental or travel coverage. Can I add a new pet to an existing multi-pet insurance policy?Yes, most insurers allow you to add a new pet to an existing multi-pet insurance policy, often applying a multi-pet discount to the additional pet. https://www.everypaw.com/multi-pet-insurance

Everypaw has a range of Lifetime cover available for cats, dogs and rabbits galore. We've laid down a little multi-pet insurance comparison table so you can ... https://www.usnews.com/insurance/pet-insurance/pet-insurance-for-multiple-pets

Several pet insurance companies offer discounts for insuring multiple pets, helping customers save money while keeping their furry friends ... https://manypets.com/us/pet-insurance/multi-pet-insurance/

... life in the ManyPets pack. Pet insurance should be easyand now it is. How pet insurance claims work. Green house with cross on it. Visit any vet. Pick a vet ...

|